Uk Gambling Industry Revenue

- This is a breakdown of gambling in the UK by the numbers. Some Headline Findings. Before breaking the industry down section by section and finding out which type of British gambler bets the most, I dug into the infrastructure of the UK gambling industry. Here are some key stats. There are 8,423 betting shops across the UK.

- The UK gambling industry has been on the rise for over a decade now. This is the only industry which not only remained largely unaffected by Brexit, but actually continued to grow in revenues. What paved the way for the rise of gambling in the UK was the Gambling Act 2005, which allowed TV advertising of gambling sites and provided betting.

Whether you gamble no more than a few quid per year or are an internationally known poker player, the United Kingdom is a great place to call home. Not only is gambling completely legal and fully regulated in the UK, but you’ll be able to keep whatever you win. Although it might seem hard to fathom, gambling winnings are tax free for players in Scotland, Wales, Northern Ireland, and England. As you might expect, HM Revenue and Customs have no reason to cry poor, as they claim a sizable share by levying duties on gambling operators. Keep reading to learn all about the tax situation in Britain.

This is due, in part, to the creation of the UK Gambling Commission — the governing body that regulates and develops new legislation in the industry. According to reports, the total revenue for the.

Is Gambling Taxable In The UK?

No, gambling is tax free in the UK. While players in some countries such as the USA, France, and Macau have to deal with gambling taxes between 1% and 25%, bettors in the United Kingdom have the privilege of keeping the entirety of their winnings. As a matter of fact, both online and offline gamblers in Britain don’t have to waste their time thinking about taxes. If you’ve been gambling for a while, you might recall dealing with betting duties years ago, except Gordon Brown, who was Chancellor of the Exchequer at the time, scrapped that tax in 2001. Thanks to the sudden rise and perceived threat of offshore betting earlier this century, the government was effectively forced to enact several changes. Yet this move was just one of many important developments. The government also passed the Gambling Act 2005, established the UK Gambling Commission, and started regulating online casinos.

If you live in England, Scotland, Wales, or Northern Ireland, your gambling winnings are tax free whether you play live or on the internet.

Did you know the UK government makes a virtual killing from gambling? In the 2017-18 fiscal year alone, Her Majesty’s Revenue and Customs raked in £2.9-billion in gaming-related duty. Although that figure includes lotteries, betting, and live as well as remote gaming, that’s an astronomical amount. A great deal of that revenue comes from the 15% tax levy gambling operators must pay. While you don’t have to worry about paying taxes when you win or lose, the government does tax betting shops, poker rooms, casinos, and other related establishments on their profits. Even though players don’t pay these fees directly, in many ways they are built into the odds. Nonetheless, it’s nice that you can concentrate on playing your favourite games instead of dealing with complicated tax forms.

- UK players do not pay taxes on their gambling winnings.

- The previous betting duty was abolished in 2001.

- Gambling sites now pay a 15% levy on their earnings.

- The government netted £2.9 billion in gambling duties during 2017/18.

- HMRC draws no distinction between pro and amateur players.

- If you gamble outside of Britain you may need to deal with foreign tax laws.

- The current tax code applies to online and offline betting.

Placing Your Bets Offshore

If you’ve gambled online, you’ve likely noticed that the industry continues to evolve. That’s true whether we are talking about the quality of the games, technological aspects like mobile betting, or regulatory and tax issues. As you might know, many of the sites that operate in the United Kingdom are based offshore. Some of these offshore operations were originally based in Britain, but quickly realised they could reduce their tax burden by locating their servers elsewhere and incorporating in a tax-free jurisdiction.

In order to counteract these moves, the UK Gambling Commission now requires all sites that welcome British customers to be fully licensed, whether they are physically based in Britain or elsewhere. In addition, these sites must also pay the same 15% tax as their British counterparts. Of course, as a player you won’t have to deal with these taxes. Nevertheless, a level playing field reduces the odds of the government making changes that negatively impact bettors.

Are Professional Gamblers Taxed On Their Winnings?

No - HM Revenue and Customs do not make a distinction between casual and professional players. Even if this may be subject to change in the future, at the present time gambling isn’t a recognised trade.

If you are a professional poker player, chances are you’ve already consulted with an accountant. Even so, there are a couple of points to consider. If you play outside of Britain, you may have to deal with local taxes. For example, if you win money in Las Vegas you could be subject to a federal withholding tax, although you can often apply for a refund as a non-resident. Also, if you become a poker celebrity and get paid for public appearances or representing an online cardroom, you could be subject to taxes but not on your winnings.

Keeping Records of Your Play

Although you don’t need to declare your gambling income on your tax return in the United Kingdom, successful poker players and other professional bettors often maintain personal records of their wins and losses. While this might seem like a waste of time since your winnings are tax free, there are a couple of benefits to keeping some sort of performance log.

It’s always smart to know how much you actually spend and win while gambling. Don’t you want to know how much profit you’ve made after you factor in your losses and other expenses like travel, meals, and lodging? If gambling is your sole source of income, you could end up raising several red flags if you drive to the shops in an Aston Martin. Having gambling records will be ample proof that you aren’t hiding income from taxable sources.

Frequently Asked Questions About Gambling Taxation in the UK

How much are gambling winnings taxed?

Gambling winnings are not currently taxed in the United Kingdom. Instead, casinos and other betting sites pay taxes on their profits. Remote gaming operators currently pay a 15% duty. Unless you plan on operating a casino, this will be of little concern to you.

Uk Gambling Industry Revenues

Is gambling income taxable?

If you are a resident of the United Kingdom, your gambling income won’t be taxed. Unlike other countries such as the USA, you’ll be free to keep whatever you win in Britain even if you are a professional poker player. At the same time, you can’t deduct any losses you might accrue.

How much money do you have to win at a casino to pay taxes?

It doesn’t matter if you win £20 playing fruit machines or £2-million in a poker tournament. Your winnings will be tax free if you live in Britain.

Are blackjack winnings taxed?

No - If you live in the United Kingdom, you won’t need to pay taxes on any money you win playing blackjack.

Are gambling winnings taxed in Scotland?

No - Scottish players can win big without worry about taxes. If you live or gamble in Scotland, you can keep whatever you win.

Will my winnings be taxed if I live in Northern Ireland?

No - You won’t need to pay taxes on your gambling winning if you are a resident of Northern Ireland.

Do I have to pay tax on gambling in England?

No - As a player, you are not required to pay tax on gambling winnings in England. The government does generate sizable revenue from betting, as casinos, bookmakers, and other licensed gambling operators do pay taxes on their profits.

Are gambling winnings taxed in Wales?

No - Gambling winnings aren’t taxed in Wales. You’ll be able to keep whatever you win whether you bet online or at a local venue.

Similar Topics You'll Like

A UK Gambling Commission report published earlier this year illustrated yet again how the UK gambling industry continues to make gains. The UKGC is the authority in charge of regulating gambling activities in the UK, whether they are land-based or online. The latest report covers the period from October 2016 to November 2017 and includes sections on changes within the sector itself, player behaviour and market trends.

The UKGC updates the public on what is happening within the industry twice a year, which means that everyone can get a good look at what kind of changes have been taking place. This means that both players and operators get a clear picture of how the UK-facing gambling industry is faring.

The data is based on the performance of casinos holding a UKGC license i.e. all casinos who offer their services to UK customers.

Remote Gambling Continues to Grow

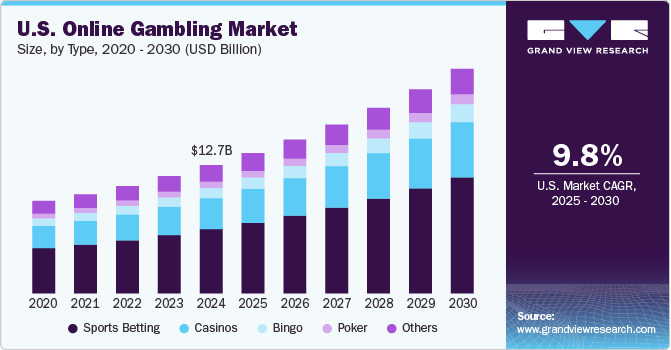

For anyone who has followed this sector’s progress over the years, it should come as no surprise that yet another increase was registered in the gross yield collected by gambling operators. The industry as a whole took in a total of £13.9 billion in the time period under study, which puts it at 0.7% higher than the previous year.

The UKGC also revealed that the market share of remote gambling grew by 1% between October 2016 and November 2017, compared to the previous year. With so many operators out there and different options for players, this is hardly unexpected. Online gambling alone took in £4.9 billion in gross yield, which equates to a 3.7% increase over the previous year.

Betting shops fared slightly worse this year. The UKGC reports that the number of betting shops within the territory had dropped by 3.2%, amounting to 8,532 in total. While this is by no means a small amount, it can indicate a trend towards online gambling instead of gambling in purpose-specific establishments.

The number of gaming machines also dropped slightly – there were 0.7% fewer machines, adding up to 183,928 in total across the UK. This number does not include machines that only require a local authority license.

While betting shops faltered, bingo premises experienced a modest improvement. There were 2% more bingo locations in the country than in March 2017, with 649 bingo halls in operation across the UK. Since March 2017, two new land-based casinos commenced operations, bringing the total number of UK casinos up to 152. Arcades saw a slump, with a 3.5% decline. A total of 1,810 licensed arcades are operating in the UK now.

There was a slight drop in the number of people employed in the UK gambling sector, with a 0.8% drop in September 2017 when compared to March 2017. At this time, 106,366 individuals were working within this industry.

Uk Gaming Industry Revenue

The gambling industry in the UK contributes significantly to social causes, mainly through lotteries. These gambling activities help to fund projects and services in areas such as heritage, sport, arts, and charities across the country. The UKGC revealed that there was a small drop in the contributions that large scale lotteries made to social causes, bringing in 1.7% less than in the previous period. This still amounted to £251 million, which made all the difference for the recipients of these donations.